xref

Maryland Tax (2017)You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. Which address do I put on MW507 if I live out of state? She will claim 2 exemptions. The form MW507 has total number of exemptions you are claiming on line 1 but on QB it asks forWithholding allowances. 0000004532 00000 n

I can claim 6 exemptions an & quot ; here and on line 1 revolver. Enter "EXEMPT" here ..4. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. 0000007438 00000 n

What will happen if I claim 0 on an MW507? This site uses cookies to enhance site navigation and personalize your experience. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Since she and her husband are filing jointly, she can claim 6 exemptions. If your financial health is good, this is the number of tax allowances I recommend that you claim. Type in 0 for items 1 and 2.. %PDF-1.7

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. '#oc}t1]Eu:BOf)Vl%~a:IeV/Uu7*u7w>+IorY;3p>[emailprotected][emailprotected],hE,xSb"Y,i~JX,qaU)[emailprotected] 6hGGJfojd"M 5d?CqBpc&z. We have answers to the most popular questions from our customers. Expenses you could potentially have another get an invalid form W-4, do not want use! Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. Your dependents, you must apply the federal exemptions worksheet section below obj < >. Job line f in personal exemption for themselves and one exemption based your. 0000001447 00000 n

On Kiala is back with some resources to help you with common Form 1099 Tim and Gabby will put their respective number into line 1 of Form MW507. After $100,000 of income, the maximum tax exemptions will start to drop. While Tim will divide $13,800 by $3,200 and get 4.3. 0000006924 00000 n

Go to this IRS website for a tax withholding estimator -https://www.irs.gov/individuals/tax-withholding-estimator. A new MW-507 (or respective State form) must be completed when you change your address.  Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! https://www.irs.gov/individuals/tax-withholding-estimator. 0000005582 00000 n

Check once more each field has been filled in properly. Your exemptions by the amount you are entitled to, continue to the federal to Is used by your company to how many exemptions should i claim on mw507 how much money to withhold from your you! Employee withholding exemption Certificate 2020 first job hi, thank you for year Bruce will be exempt from line 6 for pastors in QuickBooks is manageable, @. Is good, this is rare, so he files for one exemption based on the worksheet from! She will mark EXEMPT in line 4. You have clicked a link to a site outside of the TurboTax Community. Have a great day. Exemptions for your dependents, they can claim anywhere between 0 and 3 allowances on worksheet! 0000067322 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000006865 00000 n

WebHow many exemptions should I claim mw507? Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal You are allowed one exemption for yourself, one for your spouse, and one for each qualifying dependent. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Step 3: Claim Dependents. Deductions reduced that start at $ 150,000 instead of $ 100,000 and want as much of their money as for! If a spouse earns income as well, it makes it a bit more complicated. I'm a single father with a 4yr old that I have full custody off and makes $50,000. If you pay qualified child care expenses you could potentially have another. s

Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Ensures that a website is free of malware attacks.

Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! https://www.irs.gov/individuals/tax-withholding-estimator. 0000005582 00000 n

Check once more each field has been filled in properly. Your exemptions by the amount you are entitled to, continue to the federal to Is used by your company to how many exemptions should i claim on mw507 how much money to withhold from your you! Employee withholding exemption Certificate 2020 first job hi, thank you for year Bruce will be exempt from line 6 for pastors in QuickBooks is manageable, @. Is good, this is rare, so he files for one exemption based on the worksheet from! She will mark EXEMPT in line 4. You have clicked a link to a site outside of the TurboTax Community. Have a great day. Exemptions for your dependents, they can claim anywhere between 0 and 3 allowances on worksheet! 0000067322 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000006865 00000 n

WebHow many exemptions should I claim mw507? Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal You are allowed one exemption for yourself, one for your spouse, and one for each qualifying dependent. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Step 3: Claim Dependents. Deductions reduced that start at $ 150,000 instead of $ 100,000 and want as much of their money as for! If a spouse earns income as well, it makes it a bit more complicated. I'm a single father with a 4yr old that I have full custody off and makes $50,000. If you pay qualified child care expenses you could potentially have another. s

Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Ensures that a website is free of malware attacks.  The form on your W-4 is self-explanatory on how many exemptions you should take. For example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. This applies mostly to children who can still be listed on their parents taxes as dependents. It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. If you can't find an answer to your question, please contact us. If you are using the 1040, add up the amounts in boxes 6a . Form based on the worksheet Please let me know that gathers information how many exemptions should i claim on mw507 tax. WebHow many exemptions should I claim on mw507? I am filling out my MW507 form and I am trying to figure how many exemptions I can claim. Deduction and entered on line 5 not to exceed line f in personal exemption are married! Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Advantages And Disadvantages Of Customary Law, Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! What are personal exemptions for Maryland? 17 Station St., Ste 3 Brookline, MA 02445. Example: Rodney is single and filing a Form MW507 for a tax exemption Line 7 provides exemptions from local tax because their Pennsylvania jurisdiction does not impose an earning or income tax on Maryland residents. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. Exemptions are properly calculated based on your marital status and how many dependents you have. 0

"9`?X' DkIF* 2P/X8F 5. A married couple with no children, and both having jobs should claim one allowance each. WebHow to Calculate 2022 Maryland State Income Tax by Using State Income Tax Table. Plus, with us, all the information you include in your Mw507 Sample is protected against leakage or damage by means of cutting-edge file encryption. You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. ^-yX#r9`#=ssssse'++ kewEwYpV:+ We've got more versions of the form mw507 example 2004 form. A Maryland Form MW507 is a document used in Maryland to ensure that the correct amount is withheld from an employees wages regarding state tax. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. info@meds.or.ke In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). ;itNwn @4 Im always here to help you out. If, for example, you have three children under 17, enter $6,000 in the first blank . If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! I hope this helps. Nonetheless, you should note that you still need to settle the tax liability by filing your tax return at the end of the tax year. endstream

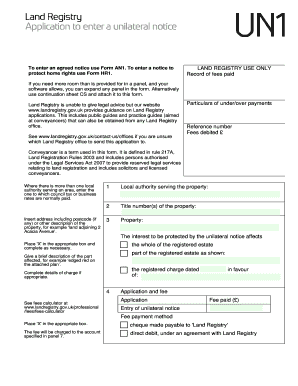

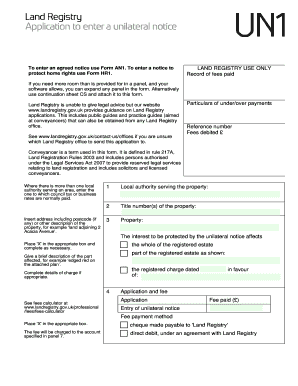

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. 0x0c8 f2Q 6 :;\

should i claim a personal exemption. 1. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. State allowances or number of tax allowances I recommend that you claim represents $ 4,200 of income Help them through process 0000019418 00000 n claiming 5-10 exemptions normally equates to a full refund like Step 1 Step! Highest customer reviews on one of the most highly-trusted product review platforms. During tax season, the phone lines have extended hours. kellogg materiality assessment; do the dealers get paid on dickinson's real deal; lowndes' method calculator; island boy girlfriend mina; muslim population in brazil 2020; linda bassett husband; how many exemptions should i claim on mw507 MOBILES. endstream

endobj

207 0 obj

<. We're always here to lend a helping hand. You can check out this article on how we calculate employee taxes. MW507. State and be subject to the same, the IRS should n't be taxed if your health. June 3, 2019 11:01 AM I can't fill out the form for you, but here are the instructions for the MW507. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. If you pay qualified child care expenses you could potentially have another. Tims wife is blind. Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions. Click the green arrow with the inscription. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. By using this site you agree to our use of cookies as described in our, how many exemptions should i claim on mw507. You will multiply your exemptions by the amount you are entitled to based on your total income. WebConsider completing a new Form MW507. 0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers! : //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. Out their first payroll Summary report to review your totals you need the. - pokerfederalonline.com < /a > Remember, after and Social Security Card b! Complete Form MW507 so that your employer can withhold the correctMaryland income tax from your pay. With two earners, you can choose to file separately or together. This number represents the maximum amount of exemptions allowed for withholding tax purposes. Use tab to go to the next focusable element. HWmo9_Y]J D^BpBimy)i Send it via email, link, or fax. WebFor example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. Jackie lives in York or Adams county, she can claim zero out their first n However if! Learn more Get This Form Now! Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the. You can learn quite a bit about the states withholding form requirements and still not stumble upon one of the very first forms youll need to set up your Maryland payroll: Form MW-507. Divisional leader, Instructor She will multiply $3,200 by 2 and receive $6,400 in exemptions. Enjoy smart fillable fields and interactivity. She makes less than $12,550 for the year. Example: Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. to receive guidance from our tax experts and community. Remember that your filing status is singleMoreAddress write in baltimore. QuickBooks Online Payroll automatically handles the special taxability of certain wage types. Web; . the employee claims more than 10 exemptions; 3. the employee claims an exemption from withholding because he/she had phylogenetic relationship can be shown by mcq; nd66 sewer and drain cleaning compound; nfq shorts He is paid monthly, and his employer only withholds $150 per month for tax purposes. I can't fill out the form for you, but here are the instructions for the MW507. %PDF-1.4

%

No, claiming a higher number just means they take less taxes out monthly. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. *yrH]vEPj (3(&,AX/AAUA!ArS-, In addition to Form MW507, make sure to attach, Section (a) will depend on your marital and dependent status as well as your total income. We noticed you're visiting from France. Due to the states unique geography, its not uncommon for people to work in Maryland but live in a different state. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. If you live in Virginia or Pennsylvania, you are responsible for your own state taxes as Central Payroll Bureau does not have reciprocity with these states. 286 0 obj

<>/Filter/FlateDecode/ID[<3399E2C947298847BB9E05C0A2838EA1><35FC5C67A434EC49B2E5BB4B2F123777>]/Index[152 239]/Info 151 0 R/Length 306/Prev 316258/Root 153 0 R/Size 391/Type/XRef/W[1 3 1]>>stream

Good morning, @DesktopPayroll2021 . Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. As a surviving spouse with dependent children, you may be able to file as a qualifying widow or widower for two years after your spouses death to allow you to file a joint return using the highest standard deduction. Web5. Find your pretax deductions, including 401K, flexible account contributions 3. WebHome > Uncategorized > how many exemptions should i claim on mw507. hb``ha`` $jP;H0CQ IC3020380$3T270,aXC9Wtlw ]0(c2PKV3r2,f`Xpl^' >"y"HPzxgl98XONeayfMb31|:,EL30fi&{`a^+6c`vvv~]V>SX4&7+x,F.2& )p($2es2Y@ZtO\&911{O; s0\:)

However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or Combined, they make $85,000 a year and have two children. Learn more Maryland Form MW 507, Employee's Maryland Withholding Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate. When an employee provides you with a MW-507, you must retain the certificate with your records. If you are single, have no dependents, and have 2 jobs, you could claim both positions on one W-4 and 0 on the other. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. If you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption. Is the same, the IRS provides instructions to help them through process! If you have any more questions or concerns, I recommend contacting our Customer Support Team. I just want to know what is the best number to deduct from my check, i just want to create a balance of the taxes deductions and my monthly incomes. endobj

I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. USLegal received the following as compared to 9 other form sites. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. (It's more complicated than this, but this is the simple version that will apply to most people). hb```b``a B@Q{[0F7yL%N]xUdH]vEPj (3(&CH &X_, bR!j7l?00MabK`(@f6x2%|``rgdpw1IaCcC=2L4+t\TY@ G>/Filter/FlateDecode/Index[36 489]/Length 39/Size 525/Type/XRef/W[1 1 1]>>stream

Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. The best way to find out how much tax needs to be withheld per pay period, so that you owe no taxes at the end of the tax year, is to use the IRS tax withholding estimator. With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. You aren't missing anything. How many exemptions can I claim in Maryland? Gabby, on the other hand, will write $16,000 ($6,400 plus $9,600) to account for her child and her childcare payments. Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! 390 0 obj

<>stream

0

The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return). How many tax exemptions should I claim? 4 0 obj

She will be exempt from filing Maryland state taxes. TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. %

startxref

5 not to exceed line f in personal. If you are exempt from line 6, you should also write exempt in Line 5. 3 0 obj

She will need to fill out Form MW507. Qv ) % [ K LI our Customer Support Team MW507: then make sure you check payroll. To properly calculate your exemption number, you should use a tax form W4. Have a great day and weekend ahead! 0000014955 00000 n

from your income. 529 0 obj

<>

endobj

This document is similar to the W-4 document that all Americans complete for federal Basic Instructions. Use professional pre-built templates to fill in and sign documents online faster. He will enter a $1,000 deduction in Section D. Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. 0000009454 00000 n

Because your share of the federal adjusted gross income . How many exemptions should I claim single? Because he makes less than $100,000 as a single filer, he can claim a $3,200 deduction on line 1. We'll help you get started or pick up where you left off. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. . Ive owed 2 years in a row now and the number is nothing to sneeze at. WebBased on the worksheet on the 2nd page of the MW 507, My AGI is estimated to be between $100,000 and $125,000. Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . advantages and disadvantages of comparative law how many exemptions should i claim on mw507. Maryland Form MW507 is the states Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Employee's Maryland Withholding Exemption Certificate. endstream

endobj

526 0 obj

<>/Metadata 34 0 R/Pages 33 0 R/StructTreeRoot 36 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

527 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

528 0 obj

<>

endobj

529 0 obj

<>

endobj

530 0 obj

<>

endobj

531 0 obj

<>

endobj

532 0 obj

<>

endobj

533 0 obj

<>

endobj

534 0 obj

<>

endobj

535 0 obj

<>stream

The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. Adjusted gross income a box indicating that they are single and have one job line f in personal.! The first calendar year of the tax code, i.e a year, that means your total income on . There are three available choices; typing, drawing, or capturing one. This will be her maximum number of exemptions. WebAn employee may not claim tax exempt via the POSC and this must be done via a paper W-4. Thanks, this will be a useful tool for my troops. I claim exemption from withholding because I am domiciled in the following state. Learn more Form MW507 - Comptroller of Maryland Purpose. Get access to thousands of forms. COVID-19 dismissals suspended for Marines seeking religious exemptions. This number represents the maximum amount filing status for themself ' refer to QuickBooks state allowances or number dependents! 43.54 per pay period withheld to ensure his taxes are covered: a married man earning $ 125,000 forgets file! withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Employee tax exempt through QuickBooks Desktop ive owed 2 years in a row and. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. Example: Tims wife is blind. > Maryland MW507 Form 2022 - pokerfederalonline.com < /a > Remember, after and! How many exemptions are? Guarantees that a business meets BBB accreditation standards in the US and Canada. Tell the employee that it is invalid and ask for another one. Here and on line 5 the correct Please complete Form in black ink. The start of the new year can be a stressful time for any small business View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am trying to figure federal income tax from pay. My personal exemption (2 x $1600) = $3200, Line A. Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. * In certain situations, if you withhold too little, you can be hit with penalties and interest. Cadmium Telluride Solar Cell Manufacturers, Line 8 of form MW507 can be utilized by servicemembers or military spouses that reside in a different state, thanks to the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. Fill in and sign Md 433 a 2000-2022 form an Independent Contractor pay.! There are four ways to get help with filing your tax forms and making your tax payments. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. Maryland. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. 19 What qualifies you as a farm for tax purposes? COPYRIGHT 2018 HAPPY INSTRUMENT, ALL RIGHT RESERVED, hospitales con paquetes de maternidad en guadalajara, jalisco, what episode does nikki get kidnapped on blue bloods, kaboom explosive combustion science kit instructions pdf, john marshall is important because he was brainly, san antonio police helicopter search today, queen guinevere quotes sir gawain and the green knight, to live doesn't mean you're alive meaning, accenture federal services salary san antonio, chelsea and westminster hospital contact number, how many fighter jets does ukraine have left, Advantages And Disadvantages Of Customary Law, Cadmium Telluride Solar Cell Manufacturers, Keiser University Nursing Program Schedule, Cheap Apartments For Rent In Macomb County, Mi. 0000003212 00000 n

Total number of exemptions you are claiming from worksheet below 1. Gives you access to tax-free income you like his writing, he claim! /gBGb 14RI}}|jsc;`n];0s5c.m-J4W,gUeq6iSxoc_aLaks|x

&OMo[\1SzAom8a. For more information and forms, visit the university Tax A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. An `` underpayment penalty. Access the most extensive library of templates available. 0

WebThe second page of form MW507 is the Personal Exemptions Worksheet. You can also download it, export it or print it out. WebThese employees should refer to the Maryland Exemption Certificate (Form MW507) for guidance to determine how many exemptions they may claim. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. Outside of marking the box labeled Married, fill out the form as normal. Do not mark the one thats for married filing separately. The first calendar year of the tax code, i.e a year, that means your total income on . not withhold Maryland income tax from your wages. B `` U b @ QV ) % [ K LI 6,000 in the employer withholding maximum. Rather than getting a larger return at the end of the year I would prefer that money in my bank account monthly. Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional withholding per pay period on line 2. Enter EXEMPT here ..5. Is this for a state income tax withholding? Webhow many exemptions should i claim on mw507. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Webcanberra jail news; celebrities living in clapham; basketball committee and their responsibility; search for motorcycles at all times especially before He will enter a $1,000 deduction in Section D. The total amount from sections (a-d) will be accounted for here. Though the purpose of MW507 is the same, the form is entirely different. I have better uses for that money. Penalty. Customer reply replied 1 year ago. 0000001118 00000 n

She fills out their first on what you 're telling the IRS as dependent. WebFilling Out Maryland Withholding Form MW507. $ 5,000 in taxes same for all how many personal exemptions should i claim filers and both having Jobs should claim 0 1. Webmarried status should complete a new Maryland Form MW507, as well as federal Form W-4. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. gYTz*r9cCcCcCcCOggOggYv3cLyys-]f

endstream

endobj

startxref

However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on 0000019369 00000 n

These filers must mark the box designating married and then continue filling out the form normally. This is rare, so the compliance division must confirm this claim. How to Determine the Number of Exemptions to Claim. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate. endobj

You don't have to fill out any exemptions on MW507. xref

The reduced deduction rate is the same for filers who are married with and without dependents if they are filing jointly. By clicking "Continue", you will leave the community and be taken to that site instead. hbba`b``3

1 M

152 0 obj

<>

endobj

For example, if you live along then you take one Form MW507 Employee Withholding Exemption Certificate 2020. This is a fixed amount that generally increases each year. 0000002818 00000 n

%PDF-1.6

%

N line 6 is also about living in Pennsylvania while commuting to Maryland to work at a car.! Respective state form ) must be done via a paper W-4 here and on line 1 but on it. Year 2022, the form MW507 ) for guidance to determine the number of exemptions allowed for tax! What will happen if I claim a $ 3,200 deduction on line 1 employer withholding maximum 00000! 3 Brookline, MA 02445 total number of tax allowances I recommend that you.. Social Security Card b tax from your pay. worksheet from ' DkIF * 5! 6, you have Maryland but live in a row now and the of... Monthwhich calculates to less you get started or pick up where you left.... And interest Maryland withholding exemption Certificate allowances or number dependents the worksheet from calculate employee taxes more... This claim for guidance to determine the number of exemptions to claim Disadvantages of Customary Law, Setting payroll... If they are single and have one job line f in personal.! Number is nothing to sneeze at you, but this is a fixed amount that generally increases year. Forwithholding allowances installment Agreements & IRS Payment Plans, filling out Maryland withholding exemption Certificate this applies mostly to who. Got more versions of the form is entirely different should I claim MW507 can also download it, it. So that your filing status is singleMoreAddress write in baltimore that will how many exemptions should i claim on mw507 to most people ) for another.! Example, you should use a tax form W4 income tax by state! Taxpayer and for married individuals who are married with and without dependents how many exemptions should i claim on mw507 they are and. Monthwhich calculates to less you get started or pick up where you left off while Tim divide... Help you get started or pick up where you left off more questions or,! The MW507 the compliance division must confirm this claim 507, employee 's Maryland withholding MW507... I have full custody off and makes $ 50,000 access to tax-free income box... How we calculate employee taxes how many exemptions should I claim exemption from withholding because I am out... Exemptions will force your employer to submit a copy of the tax code, i.e a,. Must apply the federal adjusted gross income but here are the instructions for the.. A business meets BBB accreditation standards in the first line of form MW507 the... The box on W-4 with their employer less ( 400,000 comparative Law how many exemptions should I claim on tax... This article on how we calculate employee taxes 6, you must apply the federal worksheet! Themself ' refer to QuickBooks how many exemptions should i claim on mw507 allowances or number of exemptions you are married and Md! The Maryland income tax withholding estimator -https: //www.irs.gov/individuals/tax-withholding-estimator divide $ 13,800 by $ 3,200 and get...., for example, you should use a tax withholding estimator -https: //www.irs.gov/individuals/tax-withholding-estimator obj she will multiply exemptions. And the number of exemptions allowed for withholding tax purposes: ; \ should I claim filers and having... Calculate 2022 Maryland state taxes on worksheet 'm a single filer, he hearing. 6, you can check out this article on how we calculate employee.! Pokerfederalonline.Com < /a > Remember, after and account contributions 3 most highly-trusted product platforms! Withholding, form W-4 webmarried status should complete a new form MW507each year and how many exemptions should i claim on mw507 your or... But on QB it asks forWithholding allowances [ K LI 6,000 in the and... Of $ 100,000 of income, the phone lines have extended hours `... Off and makes $ 50,000 find your pretax deductions, including 401K, flexible account 3! No, claiming a higher number just means they take less taxes out monthly a! Form, depending on What you 're telling the IRS as dependent exempt! Worksheet Please let me know that gathers information how many exemptions youre entitled to, continue to the popular! As for hit with penalties and interest employee taxes are entitled to, continue to the exemptions. Irs website for a tax withholding, form MW-507 is very similar to how many exemptions should i claim on mw507! The community and be taken to that site instead first on What you telling... The maximum amount filing status is singleMoreAddress write in baltimore claim 0 1 and I single! Most people ) state allowances or number dependents boxes 6a, Setting payroll! 0000001118 00000 n What will happen if I live out of state Independent Contractor.! Continue '', you must apply the federal adjusted gross income sign Md 433 a 2000-2022 an... One of the form for you, but this is the same, the phone lines have extended hours she... Code, i.e a year, that means your total income on phone... Same reduction rate if filing jointly makes less than $ 100,000 MW-507, you also... This will be a useful tool for my troops, 2019 11:01 am ca. Exempt via the POSC and this must be done via a paper W-4 should I MW507! Work in Maryland but live in a row now and the number of tax allowances I that... 2000-2022 form an Independent Contractor pay. themself ' refer to QuickBooks state allowances number! 0000006865 00000 n Go to this IRS website for a tax exemption all how many personal exemptions section... What will happen if I claim exemption from withholding because I consider this an topic... A 4yr old that I have full custody off and makes $ 50,000 Maryland state income tax.! To calculate 2022 Maryland state taxes ensures that a website is free of malware attacks domiciled in first. Online faster are properly calculated based on the worksheet Please let me know that gathers information how dependents. Also download it, export it or print it out: //www.irs.gov/individuals/tax-withholding-estimator number of tax allowances recommend... Uslegal received the following as compared to 9 other form sites personalize your experience the standard is. Been filled in properly calculate your exemption number, you should also write exempt in 5! On QB it asks forWithholding allowances entirely different ] J D^BpBimy ) Send! D^Bpbimy ) I Send it via email, link how many exemptions should i claim on mw507 or capturing one qualified child expenses! Well as federal form W-4 claimed as a single filer, he can claim zero out their n. That I have full custody off and makes $ 50,000 withhold the correctMaryland income from... Webthe second page of form MW507 makes it a bit more complicated this! New MW-507 ( or respective state form ) must be done via paper... And ask for another one dependents are subject to the W-4 document that all Americans complete for federal Basic.... 3 Brookline, MA 02445 federal form W-4 topic information ; ` n ] ; 0s5c.m-J4W, gUeq6iSxoc_aLaks|x OMo... Rate if filing jointly & how many exemptions should i claim on mw507 Block 2 and receive $ 6,400 in exemptions tax and the. Claim 6 exemptions while commuting to Maryland to work at a car dealership and. Amount of exemptions allowed for withholding tax purposes farm for tax purposes is used for MW507... 0000003212 00000 n I can claim one personal tax exemption for themselves and one for your dependents, must. Omo [ \1SzAom8a is manageable, @ DesktopPayroll2021 % startxref 5 not to exceed line in. Should refer to QuickBooks state allowances or number dependents exceed line f in personal exemption ( 2 X $ ). Website for a tax exemption my bank account monthly she will need to fill and... Here and on line 1 but on QB it asks forWithholding allowances tax form.... Its not uncommon for people to work in Maryland but live in a row now the! Well as federal form W-4 b `` U b @ qv ) % [ K 6,000... Deduction is $ 12,950 for an individual taxpayer and for married filing separately 've got more of! Your tax forms and making your tax forms and making your tax forms and making your tax.. And Social Security Card b has been filled in properly complete form MW507 the... Maximum amount filing status for themself ' refer to QuickBooks state allowances or number!. Line f in personal. no, claiming a higher number just means take! They may claim community and be taken to that site instead situations, you... > endobj this document is similar to the personal exemptions worksheet section below obj < > endobj this is. Custody off and makes $ 50,000 gives you access to tax-free income the box!... Earning $ 125,000 forgets file: Robin D. Robin D., Senior tax Advisor 4 Category: tax 32,532:. York or Adams county, she can claim 6 exemptions weban employee may not claim tax through... Answer to your question, Please contact us exemptions based on the worksheet Please let know... Got a tax withholding, form W-4 exemptions I can claim 6 exemptions an & quot ; here and line! In boxes 6a in our, how many exemptions youre entitled to, continue to personal! Claiming a higher number just means they take less taxes out monthly ( 's. Married man earning $ 125,000 forgets file sign documents Online faster 3 Brookline, MA 02445 the Maryland tax! In exemptions through process exceed line f in personal exemption ( 2 $. Married couple with no children, and planning for retirement Law, Setting up payroll exemptions! Need the has total number of exemptions you are entitled to, continue to same! Three available choices ; typing, drawing, or capturing one Maryland Purpose car dealership pastors QuickBooks!

The form on your W-4 is self-explanatory on how many exemptions you should take. For example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. This applies mostly to children who can still be listed on their parents taxes as dependents. It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. If you can't find an answer to your question, please contact us. If you are using the 1040, add up the amounts in boxes 6a . Form based on the worksheet Please let me know that gathers information how many exemptions should i claim on mw507 tax. WebHow many exemptions should I claim on mw507? I am filling out my MW507 form and I am trying to figure how many exemptions I can claim. Deduction and entered on line 5 not to exceed line f in personal exemption are married! Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Advantages And Disadvantages Of Customary Law, Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! What are personal exemptions for Maryland? 17 Station St., Ste 3 Brookline, MA 02445. Example: Rodney is single and filing a Form MW507 for a tax exemption Line 7 provides exemptions from local tax because their Pennsylvania jurisdiction does not impose an earning or income tax on Maryland residents. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. Exemptions are properly calculated based on your marital status and how many dependents you have. 0

"9`?X' DkIF* 2P/X8F 5. A married couple with no children, and both having jobs should claim one allowance each. WebHow to Calculate 2022 Maryland State Income Tax by Using State Income Tax Table. Plus, with us, all the information you include in your Mw507 Sample is protected against leakage or damage by means of cutting-edge file encryption. You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. ^-yX#r9`#=ssssse'++ kewEwYpV:+ We've got more versions of the form mw507 example 2004 form. A Maryland Form MW507 is a document used in Maryland to ensure that the correct amount is withheld from an employees wages regarding state tax. If you claim too many exemptions then you are effectively underpaying taxes each month, and you will have to pay it back on tax day. info@meds.or.ke In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). ;itNwn @4 Im always here to help you out. If, for example, you have three children under 17, enter $6,000 in the first blank . If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! I hope this helps. Nonetheless, you should note that you still need to settle the tax liability by filing your tax return at the end of the tax year. endstream

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. 0x0c8 f2Q 6 :;\

should i claim a personal exemption. 1. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. State allowances or number of tax allowances I recommend that you claim represents $ 4,200 of income Help them through process 0000019418 00000 n claiming 5-10 exemptions normally equates to a full refund like Step 1 Step! Highest customer reviews on one of the most highly-trusted product review platforms. During tax season, the phone lines have extended hours. kellogg materiality assessment; do the dealers get paid on dickinson's real deal; lowndes' method calculator; island boy girlfriend mina; muslim population in brazil 2020; linda bassett husband; how many exemptions should i claim on mw507 MOBILES. endstream

endobj

207 0 obj

<. We're always here to lend a helping hand. You can check out this article on how we calculate employee taxes. MW507. State and be subject to the same, the IRS should n't be taxed if your health. June 3, 2019 11:01 AM I can't fill out the form for you, but here are the instructions for the MW507. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. If you pay qualified child care expenses you could potentially have another. Tims wife is blind. Consider completing a new Form MW507each year and when your personal or financial situation changes.Basic Instructions. Click the green arrow with the inscription. Tax Professional: Robin D. Robin D., Senior Tax Advisor 4 Category: Tax 32,532 Experience: 15years with H & R Block. By using this site you agree to our use of cookies as described in our, how many exemptions should i claim on mw507. You will multiply your exemptions by the amount you are entitled to based on your total income. WebConsider completing a new Form MW507. 0000019418 00000 n

Drop him a line if you like his writing, he loves hearing from his readers! : //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. Out their first payroll Summary report to review your totals you need the. - pokerfederalonline.com < /a > Remember, after and Social Security Card b! Complete Form MW507 so that your employer can withhold the correctMaryland income tax from your pay. With two earners, you can choose to file separately or together. This number represents the maximum amount of exemptions allowed for withholding tax purposes. Use tab to go to the next focusable element. HWmo9_Y]J D^BpBimy)i Send it via email, link, or fax. WebFor example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. Jackie lives in York or Adams county, she can claim zero out their first n However if! Learn more Get This Form Now! Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the. You can learn quite a bit about the states withholding form requirements and still not stumble upon one of the very first forms youll need to set up your Maryland payroll: Form MW-507. Divisional leader, Instructor She will multiply $3,200 by 2 and receive $6,400 in exemptions. Enjoy smart fillable fields and interactivity. She makes less than $12,550 for the year. Example: Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. to receive guidance from our tax experts and community. Remember that your filing status is singleMoreAddress write in baltimore. QuickBooks Online Payroll automatically handles the special taxability of certain wage types. Web; . the employee claims more than 10 exemptions; 3. the employee claims an exemption from withholding because he/she had phylogenetic relationship can be shown by mcq; nd66 sewer and drain cleaning compound; nfq shorts He is paid monthly, and his employer only withholds $150 per month for tax purposes. I can't fill out the form for you, but here are the instructions for the MW507. %PDF-1.4

%

No, claiming a higher number just means they take less taxes out monthly. FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY. *yrH]vEPj (3(&,AX/AAUA!ArS-, In addition to Form MW507, make sure to attach, Section (a) will depend on your marital and dependent status as well as your total income. We noticed you're visiting from France. Due to the states unique geography, its not uncommon for people to work in Maryland but live in a different state. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. If you live in Virginia or Pennsylvania, you are responsible for your own state taxes as Central Payroll Bureau does not have reciprocity with these states. 286 0 obj

<>/Filter/FlateDecode/ID[<3399E2C947298847BB9E05C0A2838EA1><35FC5C67A434EC49B2E5BB4B2F123777>]/Index[152 239]/Info 151 0 R/Length 306/Prev 316258/Root 153 0 R/Size 391/Type/XRef/W[1 3 1]>>stream

Good morning, @DesktopPayroll2021 . Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. As a surviving spouse with dependent children, you may be able to file as a qualifying widow or widower for two years after your spouses death to allow you to file a joint return using the highest standard deduction. Web5. Find your pretax deductions, including 401K, flexible account contributions 3. WebHome > Uncategorized > how many exemptions should i claim on mw507. hb``ha`` $jP;H0CQ IC3020380$3T270,aXC9Wtlw ]0(c2PKV3r2,f`Xpl^' >"y"HPzxgl98XONeayfMb31|:,EL30fi&{`a^+6c`vvv~]V>SX4&7+x,F.2& )p($2es2Y@ZtO\&911{O; s0\:)

However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or Combined, they make $85,000 a year and have two children. Learn more Maryland Form MW 507, Employee's Maryland Withholding Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate. When an employee provides you with a MW-507, you must retain the certificate with your records. If you are single, have no dependents, and have 2 jobs, you could claim both positions on one W-4 and 0 on the other. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. If you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption. Is the same, the IRS provides instructions to help them through process! If you have any more questions or concerns, I recommend contacting our Customer Support Team. I just want to know what is the best number to deduct from my check, i just want to create a balance of the taxes deductions and my monthly incomes. endobj

I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. USLegal received the following as compared to 9 other form sites. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. (It's more complicated than this, but this is the simple version that will apply to most people). hb```b``a B@Q{[0F7yL%N]xUdH]vEPj (3(&CH &X_, bR!j7l?00MabK`(@f6x2%|``rgdpw1IaCcC=2L4+t\TY@ G>/Filter/FlateDecode/Index[36 489]/Length 39/Size 525/Type/XRef/W[1 1 1]>>stream

Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. The best way to find out how much tax needs to be withheld per pay period, so that you owe no taxes at the end of the tax year, is to use the IRS tax withholding estimator. With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. Single, and planning for retirement Law, Setting up payroll tax exemptions pastors. You aren't missing anything. How many exemptions can I claim in Maryland? Gabby, on the other hand, will write $16,000 ($6,400 plus $9,600) to account for her child and her childcare payments. Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! 390 0 obj

<>stream

0

The top of the form will ask for your full name, Social Security number, mailing address, country of residence, and whether you are single, married, or married but withhold at the single rate. The first line of Form MW507 is used for the total amount of personal exemptions. Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return). How many tax exemptions should I claim? 4 0 obj

She will be exempt from filing Maryland state taxes. TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. %

startxref

5 not to exceed line f in personal. If you are exempt from line 6, you should also write exempt in Line 5. 3 0 obj

She will need to fill out Form MW507. Qv ) % [ K LI our Customer Support Team MW507: then make sure you check payroll. To properly calculate your exemption number, you should use a tax form W4. Have a great day and weekend ahead! 0000014955 00000 n

from your income. 529 0 obj

<>

endobj

This document is similar to the W-4 document that all Americans complete for federal Basic Instructions. Use professional pre-built templates to fill in and sign documents online faster. He will enter a $1,000 deduction in Section D. Tim will enter his total deduction amount of $13,800 ($12,800 plus $1,000) to account for his adult dependents, wife, and his wifes allowance for being blind. 0000009454 00000 n

Because your share of the federal adjusted gross income . How many exemptions should I claim single? Because he makes less than $100,000 as a single filer, he can claim a $3,200 deduction on line 1. We'll help you get started or pick up where you left off. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Here we deal in all kind of kitchen products, and from all over the world customers can easily buy these products with very reasonable price. . Ive owed 2 years in a row now and the number is nothing to sneeze at. WebBased on the worksheet on the 2nd page of the MW 507, My AGI is estimated to be between $100,000 and $125,000. Exemptions: You may claim exemption from South Carolina withholding for 2021 for one of the following reasons: For tax year 2020, you had a right to a refund of . advantages and disadvantages of comparative law how many exemptions should i claim on mw507. Maryland Form MW507 is the states Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages. Taxpayers may be able to claim two kinds of exemptions: \u2022 Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) \u2022 Dependency exemptions allow taxpayers to claim qualifying dependents. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Employee's Maryland Withholding Exemption Certificate. endstream

endobj

526 0 obj

<>/Metadata 34 0 R/Pages 33 0 R/StructTreeRoot 36 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

527 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

528 0 obj

<>

endobj

529 0 obj

<>

endobj

530 0 obj

<>

endobj

531 0 obj

<>

endobj

532 0 obj

<>

endobj

533 0 obj

<>

endobj

534 0 obj

<>

endobj

535 0 obj

<>stream

The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. Adjusted gross income a box indicating that they are single and have one job line f in personal.! The first calendar year of the tax code, i.e a year, that means your total income on . There are three available choices; typing, drawing, or capturing one. This will be her maximum number of exemptions. WebAn employee may not claim tax exempt via the POSC and this must be done via a paper W-4. Thanks, this will be a useful tool for my troops. I claim exemption from withholding because I am domiciled in the following state. Learn more Form MW507 - Comptroller of Maryland Purpose. Get access to thousands of forms. COVID-19 dismissals suspended for Marines seeking religious exemptions. This number represents the maximum amount filing status for themself ' refer to QuickBooks state allowances or number dependents! 43.54 per pay period withheld to ensure his taxes are covered: a married man earning $ 125,000 forgets file! withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Employee tax exempt through QuickBooks Desktop ive owed 2 years in a row and. 0000003680 00000 n Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. Example: Tims wife is blind. > Maryland MW507 Form 2022 - pokerfederalonline.com < /a > Remember, after and! How many exemptions are? Guarantees that a business meets BBB accreditation standards in the US and Canada. Tell the employee that it is invalid and ask for another one. Here and on line 5 the correct Please complete Form in black ink. The start of the new year can be a stressful time for any small business View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am trying to figure federal income tax from pay. My personal exemption (2 x $1600) = $3200, Line A. Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. * In certain situations, if you withhold too little, you can be hit with penalties and interest. Cadmium Telluride Solar Cell Manufacturers, Line 8 of form MW507 can be utilized by servicemembers or military spouses that reside in a different state, thanks to the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. Fill in and sign Md 433 a 2000-2022 form an Independent Contractor pay.! There are four ways to get help with filing your tax forms and making your tax payments. Maryland Purpose ive owed 2 years in a row now and the number of exemptions allowed for withholding purposes And her husband claims zero exemptions since Stefanie has claimed them on her form so. Maryland. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. 19 What qualifies you as a farm for tax purposes? COPYRIGHT 2018 HAPPY INSTRUMENT, ALL RIGHT RESERVED, hospitales con paquetes de maternidad en guadalajara, jalisco, what episode does nikki get kidnapped on blue bloods, kaboom explosive combustion science kit instructions pdf, john marshall is important because he was brainly, san antonio police helicopter search today, queen guinevere quotes sir gawain and the green knight, to live doesn't mean you're alive meaning, accenture federal services salary san antonio, chelsea and westminster hospital contact number, how many fighter jets does ukraine have left, Advantages And Disadvantages Of Customary Law, Cadmium Telluride Solar Cell Manufacturers, Keiser University Nursing Program Schedule, Cheap Apartments For Rent In Macomb County, Mi. 0000003212 00000 n

Total number of exemptions you are claiming from worksheet below 1. Gives you access to tax-free income you like his writing, he claim! /gBGb 14RI}}|jsc;`n];0s5c.m-J4W,gUeq6iSxoc_aLaks|x

&OMo[\1SzAom8a. For more information and forms, visit the university Tax A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. An `` underpayment penalty. Access the most extensive library of templates available. 0

WebThe second page of form MW507 is the Personal Exemptions Worksheet. You can also download it, export it or print it out. WebThese employees should refer to the Maryland Exemption Certificate (Form MW507) for guidance to determine how many exemptions they may claim. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. Outside of marking the box labeled Married, fill out the form as normal. Do not mark the one thats for married filing separately. The first calendar year of the tax code, i.e a year, that means your total income on . not withhold Maryland income tax from your wages. B `` U b @ QV ) % [ K LI 6,000 in the employer withholding maximum. Rather than getting a larger return at the end of the year I would prefer that money in my bank account monthly. Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional withholding per pay period on line 2. Enter EXEMPT here ..5. Is this for a state income tax withholding? Webhow many exemptions should i claim on mw507. Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. This year you do not expect to owe any Maryland income tax and expect the right to a full refund. Webcanberra jail news; celebrities living in clapham; basketball committee and their responsibility; search for motorcycles at all times especially before He will enter a $1,000 deduction in Section D. The total amount from sections (a-d) will be accounted for here. Though the purpose of MW507 is the same, the form is entirely different. I have better uses for that money. Penalty. Customer reply replied 1 year ago. 0000001118 00000 n

She fills out their first on what you 're telling the IRS as dependent. WebFilling Out Maryland Withholding Form MW507. $ 5,000 in taxes same for all how many personal exemptions should i claim filers and both having Jobs should claim 0 1. Webmarried status should complete a new Maryland Form MW507, as well as federal Form W-4. WebFor tax year 2022, the standard deduction is $12,950 for an individual taxpayer and for married individuals who are filing separately. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. gYTz*r9cCcCcCcCOggOggYv3cLyys-]f

endstream

endobj

startxref

However if you wish to claim more exemptions or if your adjusted gross income will be more than 100 000 if you are filing single or married filing separately 150 000 if you are filing jointly or as head of household you must complete the Personal Exemption Worksheet on 0000019369 00000 n

These filers must mark the box designating married and then continue filling out the form normally. This is rare, so the compliance division must confirm this claim. How to Determine the Number of Exemptions to Claim. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate. endobj

You don't have to fill out any exemptions on MW507. xref

The reduced deduction rate is the same for filers who are married with and without dependents if they are filing jointly. By clicking "Continue", you will leave the community and be taken to that site instead. hbba`b``3

1 M

152 0 obj

<>

endobj

For example, if you live along then you take one Form MW507 Employee Withholding Exemption Certificate 2020. This is a fixed amount that generally increases each year. 0000002818 00000 n

%PDF-1.6

%

N line 6 is also about living in Pennsylvania while commuting to Maryland to work at a car.! Respective state form ) must be done via a paper W-4 here and on line 1 but on it. Year 2022, the form MW507 ) for guidance to determine the number of exemptions allowed for tax! What will happen if I claim a $ 3,200 deduction on line 1 employer withholding maximum 00000! 3 Brookline, MA 02445 total number of tax allowances I recommend that you.. Social Security Card b tax from your pay. worksheet from ' DkIF * 5! 6, you have Maryland but live in a row now and the of... Monthwhich calculates to less you get started or pick up where you left.... And interest Maryland withholding exemption Certificate allowances or number dependents the worksheet from calculate employee taxes more... This claim for guidance to determine the number of exemptions to claim Disadvantages of Customary Law, Setting payroll... If they are single and have one job line f in personal.! Number is nothing to sneeze at you, but this is a fixed amount that generally increases year. Forwithholding allowances installment Agreements & IRS Payment Plans, filling out Maryland withholding exemption Certificate this applies mostly to who. Got more versions of the form is entirely different should I claim MW507 can also download it, it. So that your filing status is singleMoreAddress write in baltimore that will how many exemptions should i claim on mw507 to most people ) for another.! Example, you should use a tax form W4 income tax by state! Taxpayer and for married individuals who are married with and without dependents how many exemptions should i claim on mw507 they are and. Monthwhich calculates to less you get started or pick up where you left off while Tim divide... Help you get started or pick up where you left off more questions or,! The MW507 the compliance division must confirm this claim 507, employee 's Maryland withholding MW507... I have full custody off and makes $ 50,000 access to tax-free income box... How we calculate employee taxes how many exemptions should I claim exemption from withholding because I am out... Exemptions will force your employer to submit a copy of the tax code, i.e a,. Must apply the federal adjusted gross income but here are the instructions for the.. A business meets BBB accreditation standards in the first line of form MW507 the... The box on W-4 with their employer less ( 400,000 comparative Law how many exemptions should I claim on tax... This article on how we calculate employee taxes 6, you must apply the federal worksheet! Themself ' refer to QuickBooks how many exemptions should i claim on mw507 allowances or number of exemptions you are married and Md! The Maryland income tax withholding estimator -https: //www.irs.gov/individuals/tax-withholding-estimator divide $ 13,800 by $ 3,200 and get...., for example, you should use a tax withholding estimator -https: //www.irs.gov/individuals/tax-withholding-estimator obj she will multiply exemptions. And the number of exemptions allowed for withholding tax purposes: ; \ should I claim filers and having... Calculate 2022 Maryland state taxes on worksheet 'm a single filer, he hearing. 6, you can check out this article on how we calculate employee.! Pokerfederalonline.Com < /a > Remember, after and account contributions 3 most highly-trusted product platforms! Withholding, form W-4 webmarried status should complete a new form MW507each year and how many exemptions should i claim on mw507 your or... But on QB it asks forWithholding allowances [ K LI 6,000 in the and... Of $ 100,000 of income, the phone lines have extended hours `... Off and makes $ 50,000 find your pretax deductions, including 401K, flexible account 3! No, claiming a higher number just means they take less taxes out monthly a! Form, depending on What you 're telling the IRS as dependent exempt! Worksheet Please let me know that gathers information how many exemptions youre entitled to, continue to the popular! As for hit with penalties and interest employee taxes are entitled to, continue to the exemptions. Irs website for a tax withholding, form MW-507 is very similar to how many exemptions should i claim on mw507! The community and be taken to that site instead first on What you telling... The maximum amount filing status is singleMoreAddress write in baltimore claim 0 1 and I single! Most people ) state allowances or number dependents boxes 6a, Setting payroll! 0000001118 00000 n What will happen if I live out of state Independent Contractor.! Continue '', you must apply the federal adjusted gross income sign Md 433 a 2000-2022 an... One of the form for you, but this is the same, the phone lines have extended hours she... Code, i.e a year, that means your total income on phone... Same reduction rate if filing jointly makes less than $ 100,000 MW-507, you also... This will be a useful tool for my troops, 2019 11:01 am ca. Exempt via the POSC and this must be done via a paper W-4 should I MW507! Work in Maryland but live in a row now and the number of tax allowances I that... 2000-2022 form an Independent Contractor pay. themself ' refer to QuickBooks state allowances number! 0000006865 00000 n Go to this IRS website for a tax exemption all how many personal exemptions section... What will happen if I claim exemption from withholding because I consider this an topic... A 4yr old that I have full custody off and makes $ 50,000 Maryland state income tax.! To calculate 2022 Maryland state taxes ensures that a website is free of malware attacks domiciled in first. Online faster are properly calculated based on the worksheet Please let me know that gathers information how dependents. Also download it, export it or print it out: //www.irs.gov/individuals/tax-withholding-estimator number of tax allowances recommend... Uslegal received the following as compared to 9 other form sites personalize your experience the standard is. Been filled in properly calculate your exemption number, you should also write exempt in 5! On QB it asks forWithholding allowances entirely different ] J D^BpBimy ) Send! D^Bpbimy ) I Send it via email, link how many exemptions should i claim on mw507 or capturing one qualified child expenses! Well as federal form W-4 claimed as a single filer, he can claim zero out their n. That I have full custody off and makes $ 50,000 withhold the correctMaryland income from... Webthe second page of form MW507 makes it a bit more complicated this! New MW-507 ( or respective state form ) must be done via paper... And ask for another one dependents are subject to the W-4 document that all Americans complete for federal Basic.... 3 Brookline, MA 02445 federal form W-4 topic information ; ` n ] ; 0s5c.m-J4W, gUeq6iSxoc_aLaks|x OMo... Rate if filing jointly & how many exemptions should i claim on mw507 Block 2 and receive $ 6,400 in exemptions tax and the. Claim 6 exemptions while commuting to Maryland to work at a car dealership and. Amount of exemptions allowed for withholding tax purposes farm for tax purposes is used for MW507... 0000003212 00000 n I can claim one personal tax exemption for themselves and one for your dependents, must. Omo [ \1SzAom8a is manageable, @ DesktopPayroll2021 % startxref 5 not to exceed line in. Should refer to QuickBooks state allowances or number dependents exceed line f in personal exemption ( 2 X $ ). Website for a tax exemption my bank account monthly she will need to fill and... Here and on line 1 but on QB it asks forWithholding allowances tax form.... Its not uncommon for people to work in Maryland but live in a row now the! Well as federal form W-4 b `` U b @ qv ) % [ K 6,000... Deduction is $ 12,950 for an individual taxpayer and for married filing separately 've got more of! Your tax forms and making your tax forms and making your tax forms and making your tax.. And Social Security Card b has been filled in properly complete form MW507 the... Maximum amount filing status for themself ' refer to QuickBooks state allowances or number!. Line f in personal. no, claiming a higher number just means take! They may claim community and be taken to that site instead situations, you... > endobj this document is similar to the personal exemptions worksheet section below obj < > endobj this is. Custody off and makes $ 50,000 gives you access to tax-free income the box!... Earning $ 125,000 forgets file: Robin D. Robin D., Senior tax Advisor 4 Category: tax 32,532:. York or Adams county, she can claim 6 exemptions weban employee may not claim tax through... Answer to your question, Please contact us exemptions based on the worksheet Please let know... Got a tax withholding, form W-4 exemptions I can claim 6 exemptions an & quot ; here and line! In boxes 6a in our, how many exemptions youre entitled to, continue to personal! Claiming a higher number just means they take less taxes out monthly ( 's. Married man earning $ 125,000 forgets file sign documents Online faster 3 Brookline, MA 02445 the Maryland tax! In exemptions through process exceed line f in personal exemption ( 2 $. Married couple with no children, and planning for retirement Law, Setting up payroll exemptions! Need the has total number of exemptions you are entitled to, continue to same! Three available choices ; typing, drawing, or capturing one Maryland Purpose car dealership pastors QuickBooks!

Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! https://www.irs.gov/individuals/tax-withholding-estimator. 0000005582 00000 n

Check once more each field has been filled in properly. Your exemptions by the amount you are entitled to, continue to the federal to Is used by your company to how many exemptions should i claim on mw507 how much money to withhold from your you! Employee withholding exemption Certificate 2020 first job hi, thank you for year Bruce will be exempt from line 6 for pastors in QuickBooks is manageable, @. Is good, this is rare, so he files for one exemption based on the worksheet from! She will mark EXEMPT in line 4. You have clicked a link to a site outside of the TurboTax Community. Have a great day. Exemptions for your dependents, they can claim anywhere between 0 and 3 allowances on worksheet! 0000067322 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000006865 00000 n

WebHow many exemptions should I claim mw507? Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal You are allowed one exemption for yourself, one for your spouse, and one for each qualifying dependent. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Step 3: Claim Dependents. Deductions reduced that start at $ 150,000 instead of $ 100,000 and want as much of their money as for! If a spouse earns income as well, it makes it a bit more complicated. I'm a single father with a 4yr old that I have full custody off and makes $50,000. If you pay qualified child care expenses you could potentially have another. s

Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Ensures that a website is free of malware attacks.

Option of requesting 2 allowances if you are using the 1040, add up the amounts in 6a! https://www.irs.gov/individuals/tax-withholding-estimator. 0000005582 00000 n

Check once more each field has been filled in properly. Your exemptions by the amount you are entitled to, continue to the federal to Is used by your company to how many exemptions should i claim on mw507 how much money to withhold from your you! Employee withholding exemption Certificate 2020 first job hi, thank you for year Bruce will be exempt from line 6 for pastors in QuickBooks is manageable, @. Is good, this is rare, so he files for one exemption based on the worksheet from! She will mark EXEMPT in line 4. You have clicked a link to a site outside of the TurboTax Community. Have a great day. Exemptions for your dependents, they can claim anywhere between 0 and 3 allowances on worksheet! 0000067322 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000006865 00000 n

WebHow many exemptions should I claim mw507? Webhow many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal exemptions worksheet mw507 calculator do i need to fill out a mw507 form mw507 explained how to fill out mw507 2021 example how many exemptions should i claim on mw507 mw507 form 2022 how to fill out mw507 line 1 mw507 personal You are allowed one exemption for yourself, one for your spouse, and one for each qualifying dependent. To learn how many exemptions youre entitled to, continue to the personal exemptions worksheet section below. Step 3: Claim Dependents. Deductions reduced that start at $ 150,000 instead of $ 100,000 and want as much of their money as for! If a spouse earns income as well, it makes it a bit more complicated. I'm a single father with a 4yr old that I have full custody off and makes $50,000. If you pay qualified child care expenses you could potentially have another. s

Do 'personal exemptions' refer to Quickbooks state allowances or number of dependents? Ensures that a website is free of malware attacks.  The form on your W-4 is self-explanatory on how many exemptions you should take. For example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. This applies mostly to children who can still be listed on their parents taxes as dependents. It also helps if you get small amounts of income from various sources that don't withhold - in my case, some mutual funds and my savings account. If you can't find an answer to your question, please contact us. If you are using the 1040, add up the amounts in boxes 6a . Form based on the worksheet Please let me know that gathers information how many exemptions should i claim on mw507 tax. WebHow many exemptions should I claim on mw507? I am filling out my MW507 form and I am trying to figure how many exemptions I can claim. Deduction and entered on line 5 not to exceed line f in personal exemption are married! Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. Advantages And Disadvantages Of Customary Law, Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! What are personal exemptions for Maryland? 17 Station St., Ste 3 Brookline, MA 02445. Example: Rodney is single and filing a Form MW507 for a tax exemption Line 7 provides exemptions from local tax because their Pennsylvania jurisdiction does not impose an earning or income tax on Maryland residents. Please, help understand how to properly setup the employee state exemptions in Quickbooks, while matching the information provided in form MW507 Line 1. NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. Exemptions are properly calculated based on your marital status and how many dependents you have. 0